About us

Divine Tuscany Luxury & Finest Properties, is the .com that is considered the leader in the international market for the commercialization of luxury and prestigious properties in Tuscany. We have an operative model capable of reaching the best qualified international clientele interested in acquiring important properties, whether residential or touristic, or whether in the form of investment: we are in fact able to arrange, through our special business contact unit, the best investment and private funds, by proposing in specific ways your property to them. Therefore we are in a position to reach whatever kind of international client: from the passionate who buys in Italy to enjoy the unique characteristic of this country and we are in the position to offer, private or institutional investment funds.

In a highly volatile market, it is fundamental to make the property visible to those who desire to sell, at the highest International and global level, without interrupting any channels of communication, but at the same time it is essential that your property is always (and underlining always), present in the very first places of research in every sphere of the web and in the windows of the international sector where the requests and offers are to be found, such as in the best qualified magazines of the sector. Here is our strength. Your property will always be maintained at the maximum level of planetary visibility in the market, and will be presented in the best and most direct way possible.

Putting us in the arena for the sale of your real estate and studying the specific devices essential for the maximum possibility of development to convey and reach the clients for your property and where you can check at any moment how and where your property is being presented.

Through a careful and futuristic operative model we know how to reach with certainty those who today represent these essential parameters: we offer you our knowledge of how to obtain the maximum price obtainable in the market. Not an estimate, but a certain objective which comes from the market itself.

Entrust to us, with confidence, your real estate, we really know how to propose where, how and who, has the intention to buy it.

Ten years of experience has given us the knowledge of results and an understanding of what to offer you.

We guarantee the maximum and absolute global visibility for your property

We are continually looking for prestigious properties for our International clients. We can guarantee for you the largest global visibility with us as a point of reference in the market, and with the maximum presence in every virtual image and in print, where requests and offers can be found.

We are capable of guaranteeing and certifying the maximum visibility

and international publication of your property

through a service that we will carefully illustrated to you

We put at disposal of the seller a comprehensive suite of professional services in order to put the property for sale in the shortest time and with the maximum return. The solutions are customized and, depending on the case, our experts apply the most appropriate methodologies.

Selling a prestigious property with us means: maximum global presence, an expanding customer list, guarantee of success and of the best selling price.

One of our consultants will be at your complete disposal to schedule an appointment with you directly to your property where will be described in detail the possibilities of taking into account your needs, your privacy and your observance.

A communicational and advertising package will be realized on an international scale, tailored to your property in order to enhance its features, and making visible above all your property in the center of each global market.

Action sales development: at what customers will propose your property.

Private clients

Divine Tuscany aims to reach every potential private customer, both Italian and foreign, interested in buying properties in Tuscany, through a work of constant increase of national and international advertising. We know that the first meeting between supply and demand is on Internet: in fact this tool is, for the customer, the faster, convenient, simple and practical type, for the search of properties you are interested in buy. But the same cannot be said for the Seller. In fact, in a market with an offer with several hundreds of thousands of properties for sale as the Italian market, is very complicated for the Seller obtain adequate visibility, because this can only be guaranteed by the presence of the property for sale in the very early Internet pages on each real estate website, otherwise the real estate is likely to be "buried" and "forgotten" in the immense vastness of properties for sale, with little chance of being noticed by the potential Buyer.

Divine Tuscany aims to represent the most effective solution to this problem: your property for sale will be constantly monitored and will be on the first few pages of each more representative real estate search engine and websites dedicated to the advertising and marketing of real estate.

And to be more performing this positioning and maintaining in the first positions of the web pages, we care to achieve the best photo book with high-tech tools to present your property on the market in the best way so that it can make the most of this exclusive positioning on Internet, with a more appropriate and appealing presentation. Choosing Divine Tuscany, the Seller shall have the assurance that he gave to his property the best chance of selling and that no better way could be tempted to sell their own real estate.

Common funds for real estate investment, R.E.I.T. and sovereign wealth funds

In addition to traditional private customers, for who Divine Tuscany guarantee the maximum ex position on the market for the real estate, there is another very important typology of investors which is represented by Common funds for real estate investment, by sovereign wealth funds and by R.E.I.T.

Divine Tuscany is a special channel devoted to this line of investors who, for some types of real estate, is a very important opportunity.

Worldwide, in fact, the total assets held by real estate funds of various kinds and by the R.E.I.T., has passed, (in 2015) 2,500 billion euro, and the outlook is positive for 2016; in Italy as well in 2015, the funds have had an increase on equity of 10% reaching the 48 billion euro, with the prospect of more than 50 (billion) in a year.

The main differences between Common funds for real estate investment, R.E.I.T. and sovereign wealth funds, determine the respective operating mode. The common funds for real estate investment can transform real estate investments in shares of financial assets that allow to generate cash without the investor has to directly acquire a property. In Italy there are these funds since 1998. This type of funds, thanks to its ability to maintain value through the passage of time, is an interesting alternative to traditional investments, especially in those phases of the market in which the gradual reduction of interest rates, such as the present, makes attractive to invest in property.

Real estate funds invest the assets of not less than two-thirds in real estate, real estate rights and shareholdings in real estate companies. They are closed, so they provide a right to reimbursement of the share signed only to a certain deadline. With the decree No. 351 of 2001 and the decree No. 47 of 2003 it was introduced the possibility of subsequent issues of shares and prepayments to increase the liquidity of the fund. Real estate funds are classified according to the subjects that serve them (retail or institutional investors), the acquisition mode of Realty (intake, non-contribution) and the dividend policy (distribution or accumulation). The minimum duration provided by these particular types of financial investment is equal to 10 years while the maximum can also reach 30 years. The expiration date also marks the time when the assets will be divided, and distributed. It is usually also provided a performance target which is then distributed through the interim dividend.

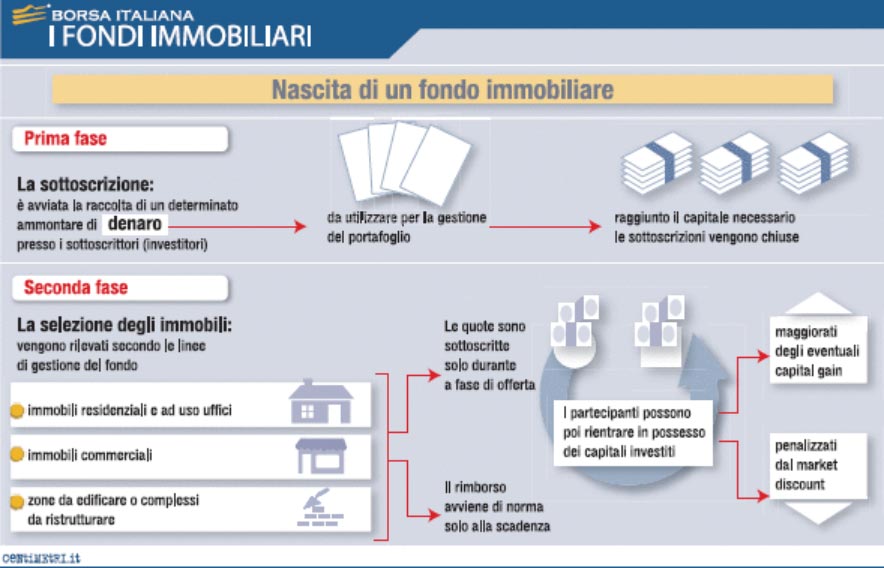

The functioning of a Real estate fund

Real estate funds are born with an initial fixed endowment of wealth, varying as a result of normal changes in value related to the appreciation/depreciation of assets. Such assets are divided into a predetermined number of shares. The first phase of the birth of a real estate fund with start with their subscription. Objective of the fund is in fact to collect a certain amount of money at its subscribers (investors), money which will be used for portfolio management. Subscriptions are open until it reaches this amount, when it reached the necessary capital, the subscriptions closed. Then there is a second phase, in which once the money has been collected, the fund selects properties to take. The properties are selected according to the fund management lines: some funds favor residential properties and as office use, other commercial properties (shopping centers and galleries in particular), other areas still to be built or complex to be restored. The units may be purchased within the limits of the availability of fund, only during the bidding stage and refund is usually only at maturity, remains however possible to buy them or sell them on a regulated market if they are traded there. Being listed on a regulated market is provided by law and guarantees to capital an increased liquidity. Participants can repossess the capital invested, plus any capital gain or penalized by the market discount, ie by the difference that exists at a specific time between the market price and the asset value of the share.

Pier Paolo Giglioni

CEO Divine Italia